Many industries are going through digitization, completely changing how products are developed and brought to market. The playing field changed completely from what it was a decade ago: new consumer expectations, new legislation, and new possibilities driven by technology.

For financial services, the need for a change is clear. Embedded services are a proven way to unlock new opportunities and improve the end customer’s value.

To make them a reality, companies must find ways to collaborate and innovate effectively, balancing personalization, data safety, and strategy

A Paradigm Shift

A shift is happening, in hearts and minds and at the ballot box to navigate the complex intersection of protecting a person’s privacy while offering embedded financial services and embedded banking. Innovation will always outpace legislation, but how and where data on us is collected has shifted, and so too must the governance that safeguards us all.

If we reframe our thinking to work backward from the problem, perhaps we can innovate and disrupt the market in new and novel ways. Changing the way we use data, anonymize data, protect it…but utilize it to solve problems facing the economy, the environment, and society at large. We can see examples of legislation popping up in parts of the Middle East and South America or even Australia which touts its Citizen Data Rights provision which enables the safe sharing of data businesses have on people with other trusted organizations.

The Emergence of Embedded Services

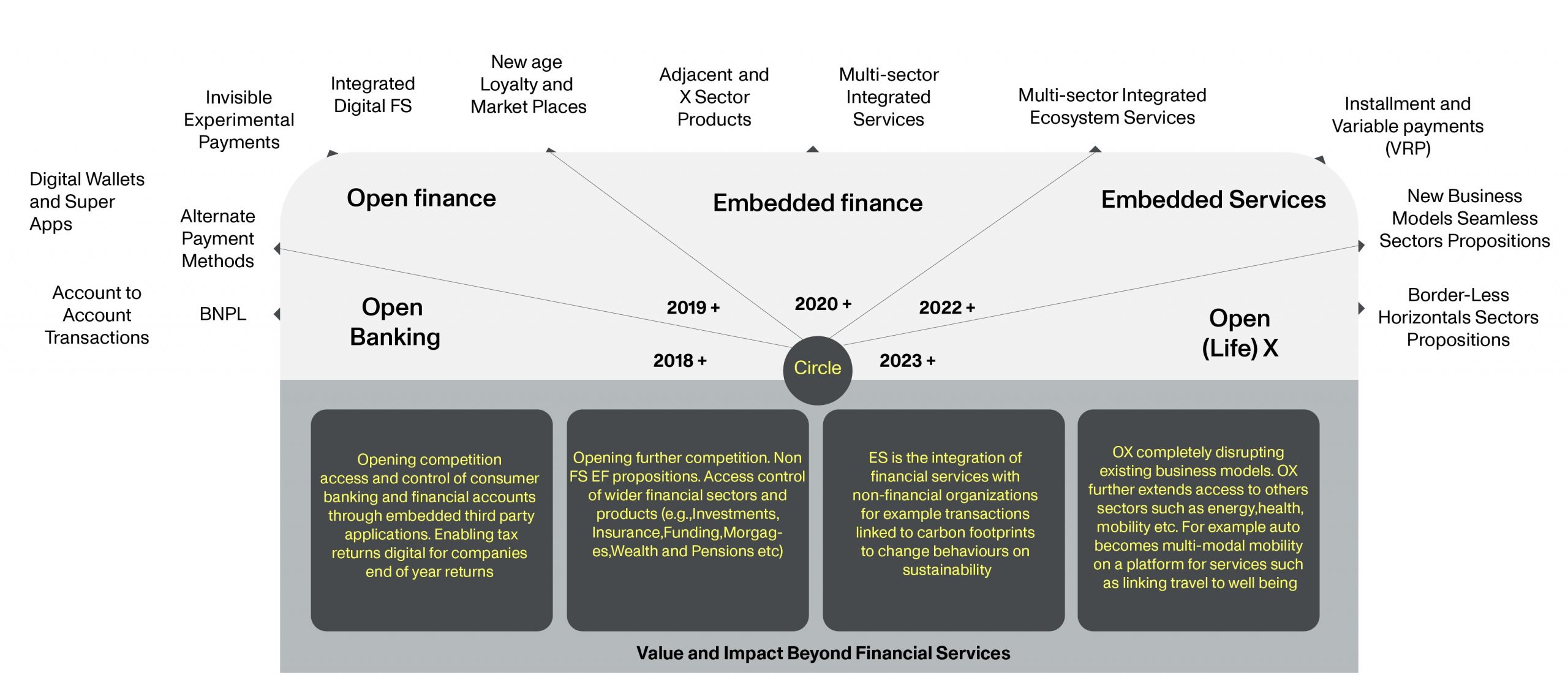

It’s important to draw a distinction between terms to understand how they can be used in practice. Here is how we define these terms:

Open Banking

Open banking refers to when banks and financial institutions provide access to third-party service providers through the use of an API or application programming interface. For example, think of your Uber app. Your payment method is stored by Uber and called upon when using their service and keeping that experience inside the app.

Open Finance

The next step after Open Banking, Open Finance refers to using banking data to build new financial products and services only using more data sources. Instead of relying only on banking information, these products and services may also use data from utility providers, insurance, and pension funds to name a few.

Embedded Finance (EF)

Embedded finance is best thought of as bringing investment tools, cards, insurance, financing and more into any non-financial product. One example is something that is a hot trend is BNPL (Buy Now Pay Later) which allows you to make an online purchase in installments, financed through a third party like Klarna.

Embedded Services (ES)

Embedding many types of services into a single app or from multiple, discreet sources is the next evolution in creating cross-platform customer experiences. This term is fairly open and can refer to a number of different products and services working in combination together through APIs to connect a consumer ecosystem.

Here is a sample path for organizations to explore, when considering bringing embedded services into their ecosystem.

Embedded finance is set to touch $230BN in revenue by 2025 and could potentially reach up to $1TN in value.[1]

This growth is possible because it represents a fundamental shift to integrate services that will use data engineering and technology to seamlessly link markets and ecosystems.

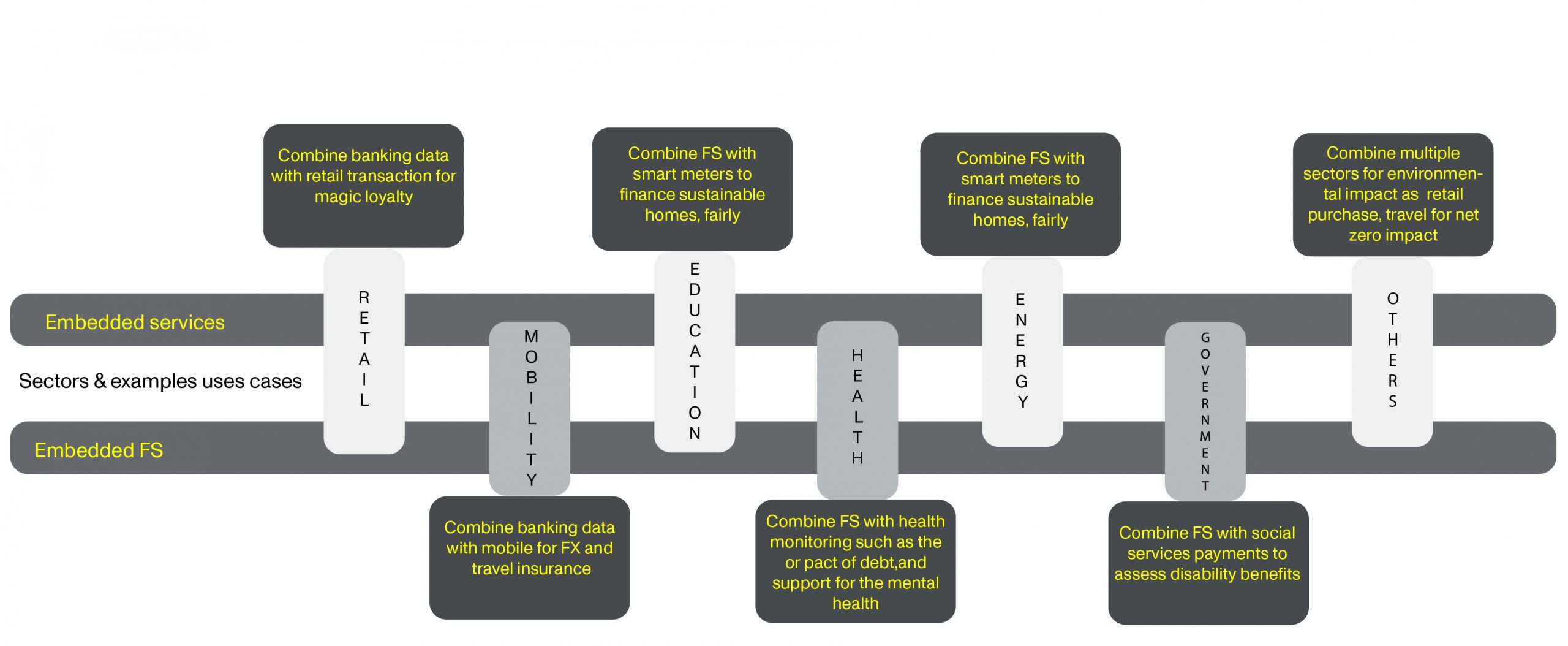

One great example is using multiple modes to transport automobiles, where insurance can be cost-adjusted based on the environmental impact of the trip. Making it personal, and horizontal, insurance companies could take health and activity data from wearables to create more customized offerings that meet the users’ specific needs. The diagram below explains the relationships a bit more.

Forward-thinking organizations who want to embrace the emergence of embedded finance and services need to think horizontally to meet the consumer where they are.

Defined by Purpose and Visionaries

There is enough momentum and players in the space that we can craft some Target Operating Models around ‘whole-brained’ teams with cross-sector expertise. Teams need to be multi-disciplined, wedded to a culture that focuses on a customer-centric experience and delivering value. A carefully constructed team with the right vision, knowledge, and attitude can drive innovation forward with ethics, and governance that build trust with customers. The diagram below shows the horizontal design approach which best enables your innovators to succeed.

Monstarlab is uniquely positioned with the expertise, technology, and data background combined with our focus on the human experience. We work with leading financial institutions across the globe to bring the concept of embedded banking, embedded finance, an embedded services to reality.

To bring embedded banking, embedded finance, and embedded services to reality you need an expertise in technology and data, but also a focus on human experience.

To bring it all together, leading financial institutions and service providers, partner up with digital transformation consultancies like Monstarlab.

Check out how we helped SNACK by Income bring insurance products to a new generation of digital natives, and created digital customer experience for Danske Bank and Mashreq Bank.

References

[1] M.Harris, A.Davis, B. Adams, and J.Tijssen, Embedded Finance: What It Takes to Prosper in the New Value Chain, Bain and Company, 2022