By Daniel Kalick, Director of Strategy, Monstarlab

Part of our Wholesale, Retail, & eCommerce Series

The quest to reopen stores is just the beginning. To emerge stronger from the pandemic, brands must reimagine the in-store service model altogether, identifying new opportunities to monetize physical space, streamline operations, and deepen customer relationships. All of which we will cover in this article.

.

***

The fits and starts of reopening amid the pandemic have many brands getting creative with ways to deliver in-store service while keeping customers and employees safe. From retailers to restaurants and banks, the constraints imposed by Covid have made it critical to experiment with contactless forms of service and a variety of new spatial configurations.

Yet reopening alone won’t guarantee success in the “next normal.” For companies that depend on a large physical footprint to do business with customers, the pandemic is provoking a much deeper, structural question –– one that goes beyond the way to best jump-start activity at brick and mortar stores.

That question is whether those stores, as currently conceived, will continue to deliver enough business value to justify their cost in the first place.

Fact is that many customers might not be returning to main street shops as often, even once the economy recovers and the pandemic fades from view.

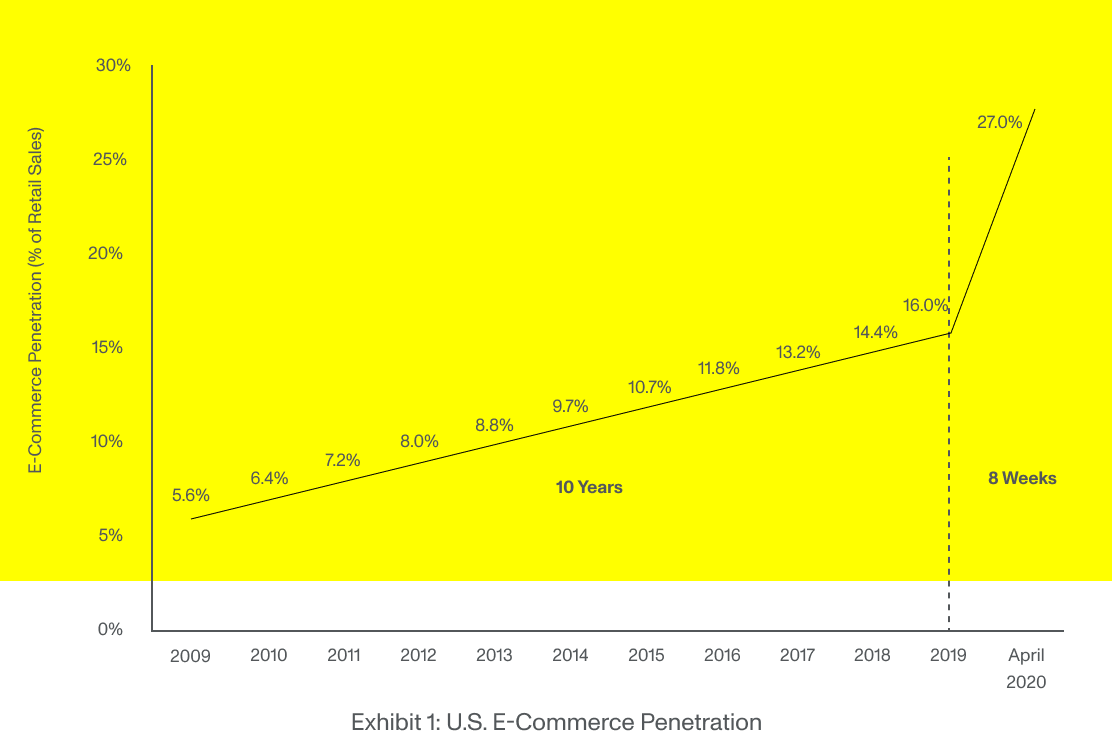

That’s because Covid has rapidly accelerated changes in consumer behaviour. If adoption of eCommerce had been inching up before the pandemic, it has now hit a massive growth spurt. The many late adopters who previously shunned digital services are rapidly changing their ways, and some of that change will likely be permanent.

Companies are rapidly adjusting in turn, pivoting to digital channels to meet the changing needs of consumers. If these channels continue to deliver a greater share of revenue even after stores reopen, and margins can be improved by reducing acquisition and distribution costs, the very purpose of main street shops will need to be examined.

The brands to emerge strongest from the pandemic will face this shifting landscape head-on. They won’t let “getting back to normal” become a singular obsession. Instead, they’ll proceed on two tracks, implementing the best solutions to safely reopen in the short-term, while reimagining the in-store service model in the longer term and taking bold steps toward the future.

***

The longer-term track entails identifying and experimenting with bigger, riskier opportunities to innovate the in-store experience from both an operational and customer perspective. While specifics of execution will differ from brand to brand, and industry to industry, the path begins with a similar set of strategic imperatives:

- Identify the unique value that only in-store service can deliver.

There will always be a substantial segment of customers who prefer to walk into stores and restaurants, either spontaneously or planned. But as consumers have become more and more accustomed to home delivery and other off-premise channels –– and as businesses have in turn grown more reliant on those channels for acquisition and distribution –– the question brands must ask is what differentiated value the in-store experience can offer. What, in other words, is the job that physical storefronts are uniquely positioned to do for customers?

Answering this question entails thinking about the friction that can be best alleviated by face-to-face interactions and the problem-solving creativity of store employees. Retailers like Nordstrom, for example, have recently piloted a merchandising-only concept[2] that focuses solely on helping customers find the right clothes. The concept marks a return to the heyday of the department store experience[3] of the 1950s when sales associates had greater expertise in fashion trends and were more attuned to the tastes of their most frequent customers. This type of high-touch, personalized service is hard to execute outside a physical store.

- Test new opportunities to monetize physical space.

With customer capacity limited at many stores and restaurants amid the pandemic, the cost of physical locations has for many companies dwarfed the revenue generated by those locations. This crunch has pushed brands to envision smaller, less costly footprints, particularly in the restaurant industry, where leaders like Burger King are concepting future designs up to 60% smaller[4] than today’s traditional restaurant.

In addition to reducing real estate costs, brands are renewing the quest to further monetize the physical space they already have. Service model innovation in this area has already led to positive results. Restaurant chains like Chili’s, for example, are piloting ‘virtual brands’[5], using increased kitchen capacity during the pandemic to launch delivery- and takeout-only concepts that are adding substantial incremental revenue.

As restaurants and retailers alike use physical storefronts more and more as distribution centers for goods that have been purchased through digital channels ahead of time, it’s useful to consider the monetization opportunities that might exist as a result of this shift. How can brands upsell customers with relevant offers as they head to collect their purchase from a pick-up counter or BOPIS (Buy-Online-Pickup-In-Store) locker? The most effective way to monetize this part of the customer journey has yet to be fully explored.

- Pilot technologies that enable streamlined operations and deeper customer relationships.

As more technologies form part of a brand’s digital ecosystem, both operations and customer relationships stand to be impacted, and not always in a positive way. While digital ordering opens a much-needed revenue stream for retailers and restaurants, for example, it can also introduce a host of pain points for in-store employees. Likewise, while retail and restaurant marketplaces are adept at bringing new customers to brands, the relationship (along with a sizable chunk of transactional revenue) is often owned by those marketplaces, placing roadblocks in the way of deeper customer engagement.

Brands looking to innovate the in-store model have an abundance of technology options that hold the promise of driving both operational efficiency and deeper customer relationships, from real-time inventory management to AI-driven recommendations across digital and physical channels. Finding the technologies that will unlock the unique value of the in-store experience, without negatively impacting operations or the long-term customer relationship, is key.

***

As we find our way out of the pandemic, the reopening of main street shops is highly anticipated – but it’s only the beginning for brands that rely on a large physical footprint to do business. Shifts in consumer behaviour accelerated by Covid mean it’s more critical than ever for retailers, restaurants, and banks to innovate the in-store service model. By identifying the unique value that only in-store service can deliver, finding new opportunities to monetize physical space, and choosing technologies that enable streamlined operations and deeper customer relationships, brands can ensure that stores will continue to drive business in the next normal.

Meet the Expert:

Daniel Kalick, Monstarlab Americas’ Director of Strategy, has over a decade of experience in driving digital innovation and organizational transformation in leading B2C brands globally.

Read more insights and see some of our works on Wholesale, Retail, & eCommerce