By Tobias Lund-Eskerod, Strategy and Delivery Lead, Monstarlab

Moving into a new decade, any company operating in a customer-facing industry faces the ramifications of the rapid digital development that has permeated society. Customers are increasingly tech-savvy and have grown accustomed to having everything available at their fingertips.

From food delivery to ride-hailing to financial management – customer expectations for great experiences have grown to transcend the boundaries of product and category. They want it all seamlessly integrated into their digital lifestyle, preferably with a layer of curated personalization as the cherry on top.

Transforming for the digital economy

The financial services industry has not evaded the pressures of customer expectations. Consequently, sparks of innovation are being ignited across the playing field coming from novel Fintech disruptors to seasoned financial services organizations (FSOs) to a joining of forces between the two in collaborative banking.

To succeed in the digital economy, FSOs must get on board and seize the momentum of digitization and the possibilities to improve CX offered by digital technologies and data analytics. If they underestimate the magnitude of disruptive technologies and the impact it will have, they are not going to make it.

While we stress the urgency of digital transformation, we realise that it is not an easy undertaking. Depending on the point of departure, it can indeed be a daunting endeavour with a considerable risk of failure.

However, with the right prioritization and a sharp focus on customers as the epicentre of the digital transformation, FSOs can successfully transform and future-proof their business.

In highly competitive industries, such as financial services, customers are heavily influenced by the quality of digital experiences. The ability to provide personalized, relevant and efficient digital experiences is not only a way for financial services organizations to differentiate their brands but also to increase conversions for key moments in the customer journey.

– Chris Nash, Director of Digital Experience Optimization, Monstarlab

Reviewing the customer experience to identify key pain points

A good place to start is to take a holistic view of your end-to-end customer journeys and ask yourself whether you are currently offering the solutions that your customers want.

To better understand who your customers actually are and how they prefer to interact with your products and services, defining your customer segments, creating personas and mapping customer journeys and decision-making along those journeys will aid you tremendously.

This will enable you to identify the phases in their journeys that negatively affect CX, which will in terms allow you to better prioritize your improvements to offer increased convenience to your various segments.

Here’s an example. As depicted above, recent global research shows that different consumer types (personas) have varying appetites for omnichannel services, meaning a mix of physical and digital services that allow them to switch seamlessly in the customer journey.

Depending on the composition of your segments, obtaining such information could potentially aid you in deciding whether you should digitize one or more of your services.

Another interesting take away from the study above is that more than fifty percent of all surveyed consumers (on average) do want the opportunity of both digital and physical.2

An equally advantageous benefit of getting to know your customers is the insights it gives you about their core needs. This can enable you to drastically increase the relevance of your customer engagement initiatives.

Addressing core needs with personalized customer engagement

Personalization has the potential to save customers time and money while making them feel like the business has an in-depth understanding of their unique needs, for instance by providing tailored advice based on spending patterns or relevant offers based on interests. Customers want personalization that offers true value.2

However, delivering personalization that is relevant is seemingly a challenge that many FSOs are facing. According to research, seventy percent of FSOs state that understanding individual customer needs is a key challenge to meeting customer needs and expectations.3

But surprisingly, more than seventy-five percent of consumers are actually willing to trade their data with FSOs for reciprocal customized experiences, advice and benefits.2

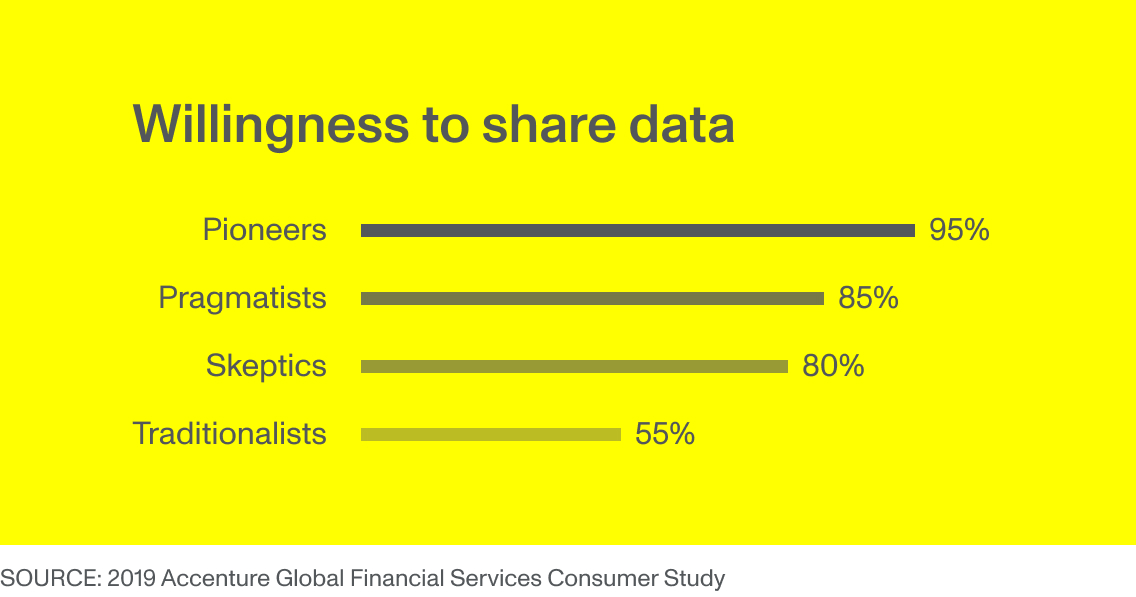

While willingness to share data does vary across personas, just like appetite for omnichannel, most consumers do want the benefits of a personalized experience.

Research even shows that seventy-seven percent of consumers prefer to do business with companies who use their information to make experiences more efficient.4

Moreover, data-driven personalized advice and services can earn increased trust, loyalty and advocacy.5,6

You can say that data has become a type of currency that customers are willing to trade for increased value.

Every interaction from every customer equates to data that has an increasing business value. Leading-edge organizations leverage digital-experience data to differentiate and grow their brands

– Chris Nash, Director of Digital Experience Optimization, Monstarlab

We believe that this represents a huge opportunity for FSOs to co-create value with customers and position themselves as customer-centric. If they set up the framework to harvest customer data, they can provide curated hyper-relevant services, advice, support and offers based on what customers want and need and drive loyalty, trust and performance.

Abandoning legacy systems to improve CX

Cumbersome legacy systems can be a true challenge when trying to improve CX.

Replacing legacy systems with newer solutions can give you the tools to dramatically improve immediate availability, personalisation, cross-function and stability of your services.

Therefore, you should consider whether your current systems are aiding or failing you in achieving all of the above.

Depending on how far along you are in your digital transformation, contemplating the key areas we’ve highlighted above may help you assess the capability of your current operating model in serving customers the way that today’s customers want to be served.

CX best practice

According to research, fundamental change towards a customer-centric approach along with operational and IT improvements can increase customer satisfaction remarkably.8

This was the case with Danske Bank, Denmark’s leading bank and a major retail bank in the northern European region with over 5 million retail customers.

Danske Bank’s ambition is to provide the best customer experience in the Nordics and to become no. 1 in customer satisfaction in their market. To achieve this goal, they partnered with Monstarlab to embark on a CX transformation journey.

The challenges of a legacy system and a company-centric strategy

Danske Bank faced a challenge with their old homepages, which were based on a legacy system. They were designed from an inside-out perspective, focusing on banking needs and product information.

The approach was company-centric and sales-focused without much personalization or direct relation to actual customer needs. This, combined with the fact that their sites were not mobile-friendly, resulted in low customer satisfaction.

Danske Bank realized that they needed a shift in strategy to a customer-centric approach in order to improve the experience of interacting with their products and services. They needed to flip the value-proposition on its head and focus on offering services tailored to the core needs of customers instead of pushing product information. It was clear that their old system could not support this vision.

Danske Bank wanted us to help them use the Sitecore technology to create a new customer-centric and hyper-personalised universe that would perform across all devices.

Unfolding the potential of Sitecore to deliver hyper-relevant personalization

As experts in maximising the opportunities of Sitecore to improve CX, we worked closely with Danske Bank to create and launch a new platform that would deliver personalised experiences for their customers.

Sitecore was used as a centralized hub to distribute Danske Bank’s content throughout their digital channels and then harvest the interactions to constantly improve on personalization.

– Rune Alblas, CPO Sitecore, Monstarlab

Based on the complex data-driven segmentation that the Sitecore architecture allows, Danske Bank could now provide tailored individual experiences that speak directly to customers’ unique life stages, goals and events.

Monstarlab helped Danske Bank from inception to post-implementation in order to unfold the Sitecore personalization engine and CMS. The new Sitecore platform has given autonomy to content managers at Danske Bank to continuously build, test and optimize pages and content based on changes in customer needs in a co-creation process with customers.

A new consumer-centric experience and immediate ROI

The result of this partnership was an entirely reinvented online experience that focuses on customers and how Danske Bank can support their financial decisions with a hyper-relevant universe.

Based on the new, optimized and responsive design of the platform with personalised content, Danske Bank’s CX has improved as much as to achieve ninety percent positive feedback from customers after the launch. Customers now spend much more time browsing the personalized life events pages, which has resulted in a fifty-six percent increase in leads.

Furthermore, the improved ability to roll out targeted communication for new products and services has generated a positive ROI within the first year of implementation.

Danske Bank won the Sitecore implementation for Content Management Strategy in Scandinavia in 2016 and the Best Business Impact or ROI from a Digital Experience in 2019 in the Sitecore Experience Awards.

The Danske Bank project, which we are proud to be a part of, is just one of many examples of how a CX transformation can create value both for FSOs and their customers, and how Sitecore can be instrumental in facilitating that transformation.

It is our experience here at Monstarlab, that FSOs who put humans at the center of their digital transformation are able to differentiate themselves, both in terms of profitability, efficacy and customer satisfaction. But they are also able to future-proof their operations.

– Zayne Nair, Delivery Director, Monstarlab